A joint venture is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to access a new market, particularly emerging markets; to gain scale efficiencies by combining assets and operations; to share risk for major investments or projects; or to access skills and capabilities.

JV is a concept that LOU are able to enter into, depending on the lease type and agreed conditions, this is a concept in which LOU can be empowered in.

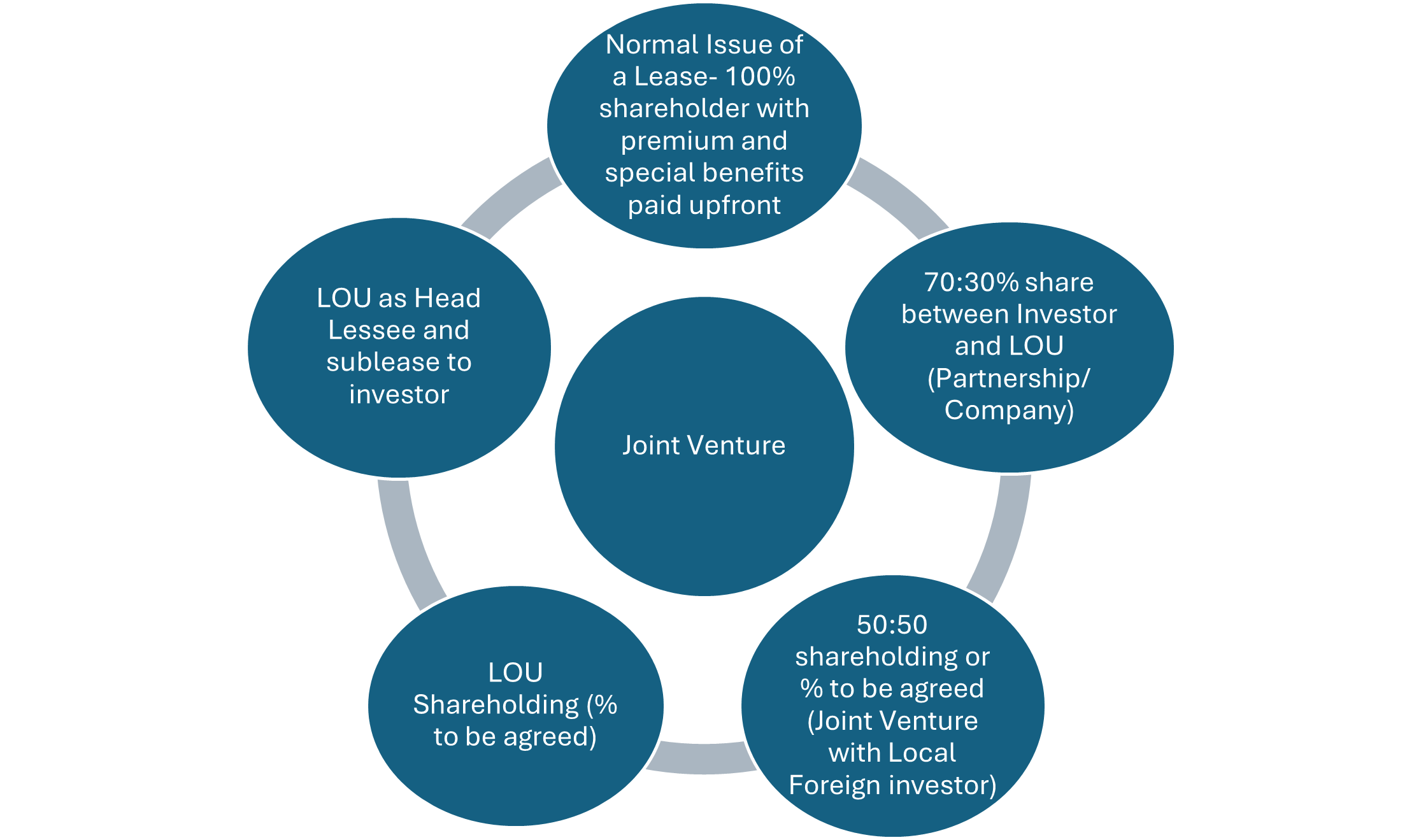

There are 5 options that can be explored by LOUs and registered companies for this purpose:

Investment potentials for LOU and business partners:

- The Board through the Tourism Department and in liaison with respective financial and investment organisations (e.g. Unit Trust, Fijian Holdings, and Financial Banks) shall provide necessary advice and information to the LOU’s with respect to committing a percentage of their premium payments for investment purposes for the future wellbeing of the members of the landowning units.

- Five (5) options to which Joint Ventures may be considered by the interested parties. This is currently applicable through Tourism development ventures. However, it must be noted, that the board may consider similar arrangements for purposes other than Tourism in accordance with its regulations and policies.

OPTION 1: Normal Issue of a Lease

The applicant (Local/Foreign) has the right to take up a lease with the normal Tourism leasing conditions. The Investor has 100% shareholding but the premium and special benefits are paid to the LOU upfront. A minimum percentage of preferential/free shares shall be given to the LOU and which vests with them for the duration of the lease. In this option, lease terms shall be 99 years but the rolling concept to be implemented. Hence the consultations for the renewal of lease shall commence from the sixty fourth (64) year of the lease (remaining unexpired term thirty five (35) years.

OPTION 2: 70:30% share between Investor and LOU (Partnership/ Company).

The LOU can be a partner in the company with the physical value of the land at current market rates being put in as their share but they shall still be entitled to payment of only partial premium payments and other benefits e.g. education funds, training etc. as stated in their MOU with the company in line with the tourism policy.

OPTION 3: 50:50 shareholding or % to be agreed (Joint Venture with Local/foreign investor).

The opportunity to provide a 50:50 shareholding arrangement between the LOU and the purchaser. The LOU can be a partner in the company with the physical value of the land and the premium value being contributed as shares. The LOU shall still be entitled to payment of special benefits in line with the Tourism Policy and which shall be specified in the MOU. The registered LOU Company shall be joint partners with another party (local or foreign) in its proposition to undertake a tourism project. Financial arrangements/agreements shall be on the sole discretion of the two companies and in compliance with relevant approving authorities (Investment Fiji, Reserve Bank of Fiji, etc.).

The LOU shall in its interest, provide as collateral to the business:

- Forego or reinvest the quantum of premium as agreed by TLTB.

- Quantum of other special benefits as agreed by TLTB/ purchaser.

- Physical land – UCV calculated at current market rates.

OPTION 4: LOU SHAREHOLDING (% to be agreed)

A shareholding arrangement with the potential company based on;

• No premium payments.

• No special benefit entitlements in line with Tourism Policy.

OPTION 5: LOU as Head Lessee and sublease to investor.

The Land Owning Unit to lease the land as the Head Lessee and sublease the property/ subject site to the investor. Investors going into JV is a business decision and involves a legal process outside the iTaukei Land Trust Board (TLTB) but the opportunities for taking up iTaukei leases can be between:

– Investor/Government

– Government/Landowning Unit

– Investor/Landowning Unit

– Investor/ Investor (Company, NGO, CSO, Individual)

– Company/Individual (Tenant/Farmers)

Requirements:

Refer to our list lease requirements (depending on the lease type and requirement for Companies and for Individuals) and in addition to this a copy of the Joint Venture Agreement or registration certificate

Appropriate Areas of Investment:

- Land Development (subdivisions for housing, commercial, industrial, integrated development, tourism;

- Agriculture including Commercial Agriculture;

- Commercial;

- Tourism;

- Conservation;

- Afforestation, Reforestation;

- Renewable Energy

Basically JVs can be pursued in any type of lease depending on the scale of development and viability to have such an arrangement in view of other business arrangements.

TLTB encourages JVs with landowning units to empower landowners to participate in the decision making process of development projects on i Taukei land and empower them to take risks and enable them to also share the direct benefits which includes capital injections and capacity building.